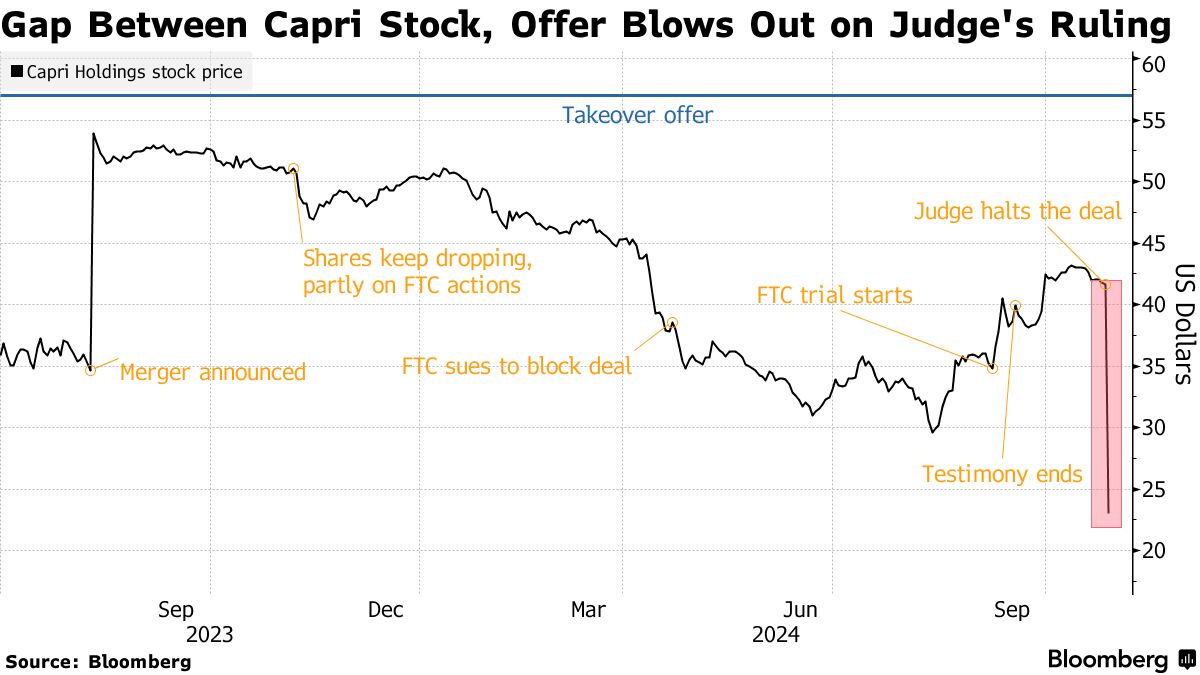

In the world of high fashion and luxury retail, mergers and acquisitions often make headlines as brands seek strategic partnerships to expand their market share, increase global reach, and enhance their product lines. Recently, a major deal within the luxury retail sector drew widespread attention: Tapestry Inc., the American fashion giant known for brands like Coach, Kate Spade, and Stuart Weitzman, made an offer to acquire Capri Holdings Limited, the parent company of Michael Kors, Jimmy Choo, and Versace, for an impressive $8.5 billion. This proposed merger was set to create one of the largest U.S.-based luxury fashion conglomerates. However, following a decision by a U.S. District Court, this high-profile acquisition has been temporarily halted, triggering an immediate decline in Capri’s stock. The court’s decision reflects the complexities and regulatory challenges often associated with large acquisitions in the luxury fashion space, adding a new chapter to the evolving story of Tapestry and Capri’s growth ambitions. Follow us here at Boohoo Responds to Fraser's Letter.

Tapestry Inc

Tapestry Inc. has long been a prominent player in the global luxury market. Originally founded in 1941 as Coach, the company rebranded to Tapestry in 2017 to better reflect its portfolio of luxury brands, which include Coach, Kate Spade, and Stuart Weitzman. Tapestry’s strategic acquisitions and brand development efforts have solidified its presence in the luxury accessory and handbag market. As a modern luxury conglomerate, Tapestry has managed to appeal to a diverse clientele, bridging the gap between accessible luxury and aspirational fashion. In recent years, the company has prioritized growth through acquisitions, recognizing the benefits of brand diversification in an increasingly competitive landscape.

Tapestry’s offer to acquire Capri Holdings was seen as a bold move to establish itself as a formidable U.S.-based competitor to European luxury conglomerates like LVMH and Kering. The proposed $8.5 billion deal was structured to bring together some of the most iconic names in fashion, to expand Tapestry’s presence across both American and international markets. This acquisition was also intended to foster synergies between Tapestry’s and Capri’s established brand infrastructures, which would provide a broader global reach and increased financial stability. However, with the recent court decision to block the acquisition, Tapestry’s vision of becoming a global luxury giant has encountered a significant setback.

Related: Venom: The Last Dance (Film)

Related: Territory (Series)

Capri Holdings Limited

Capri Holdings Limited, formerly known as Michael Kors Holdings, has experienced its evolution as a luxury fashion entity. Michael Kors, the brand’s namesake and original label, was founded in 1981 and gained recognition as a luxury American brand offering high-quality handbags, accessories, and ready-to-wear collections. As Michael Kors grew, it leveraged its financial strength to acquire two other globally recognized luxury brands: Jimmy Choo in 2017 and Versace in 2018. These acquisitions marked Capri’s transition from a single-brand company into a diversified luxury fashion holding, further expanding its influence in the high-end market.

Capri’s portfolio boasts a unique combination of brands that offer distinct aesthetic appeals and market segments. Michael Kors represents accessible luxury, Jimmy Choo is synonymous with glamorous footwear, and Versace is celebrated for its bold, opulent designs. Together, these brands contribute to Capri’s identity as a diversified yet cohesive luxury holding. This diversity was part of the attraction for Tapestry, as acquiring Capri Holdings would allow Tapestry to expand its reach into the realms of both accessible luxury and ultra-luxury. The acquisition was positioned as a strategic alignment that would complement Tapestry’s existing offerings, making the U.S. company a noteworthy competitor on a global scale.

However, the recent ruling by the U.S. District Court has placed Capri in a precarious position. The halt on the acquisition led to a rapid decline in Capri’s stock price, reflecting investor concerns regarding Capri’s independent growth trajectory and the future of its flagship brands without the anticipated support and resources that would have come from a Tapestry partnership.

U.S. District Court Blocks the Acquisition

The U.S. District Court’s decision to block Tapestry’s acquisition of Capri Holdings came as a surprise to many in the fashion and financial communities. The court’s ruling, which temporarily halts the acquisition, centers around regulatory scrutiny and antitrust concerns. When a merger or acquisition of this scale is proposed, regulatory bodies evaluate potential impacts on market competition, consumer choice, and overall industry dynamics. In this case, the court’s intervention suggests a need to examine how a combined Tapestry-Capri entity could affect competition within the luxury fashion sector, particularly in the U.S. market.

The court’s decision has immediate implications for both Tapestry and Capri Holdings. For Capri, the blocked acquisition represents a significant blow to investor confidence, as evidenced by the swift decline in Capri’s stock price following the news. The company had anticipated that joining forces with Tapestry would strengthen its market position and provide additional resources to further develop its brands. Without this partnership, Capri will need to reassess its strategy to maintain its competitive edge in a fast-changing industry.

Meanwhile, for Tapestry, the court’s decision halts its expansion plans and raises questions about its future growth strategy. The acquisition of Capri was expected to bolster Tapestry’s brand portfolio, providing synergies that would streamline operations and reduce costs across both entities. Now, Tapestry faces the challenge of achieving its growth objectives without the immediate boost that Capri would have provided. Additionally, Tapestry must navigate the legal and regulatory obstacles that have arisen, potentially engaging in negotiations with regulators or considering alternative paths to expansion.